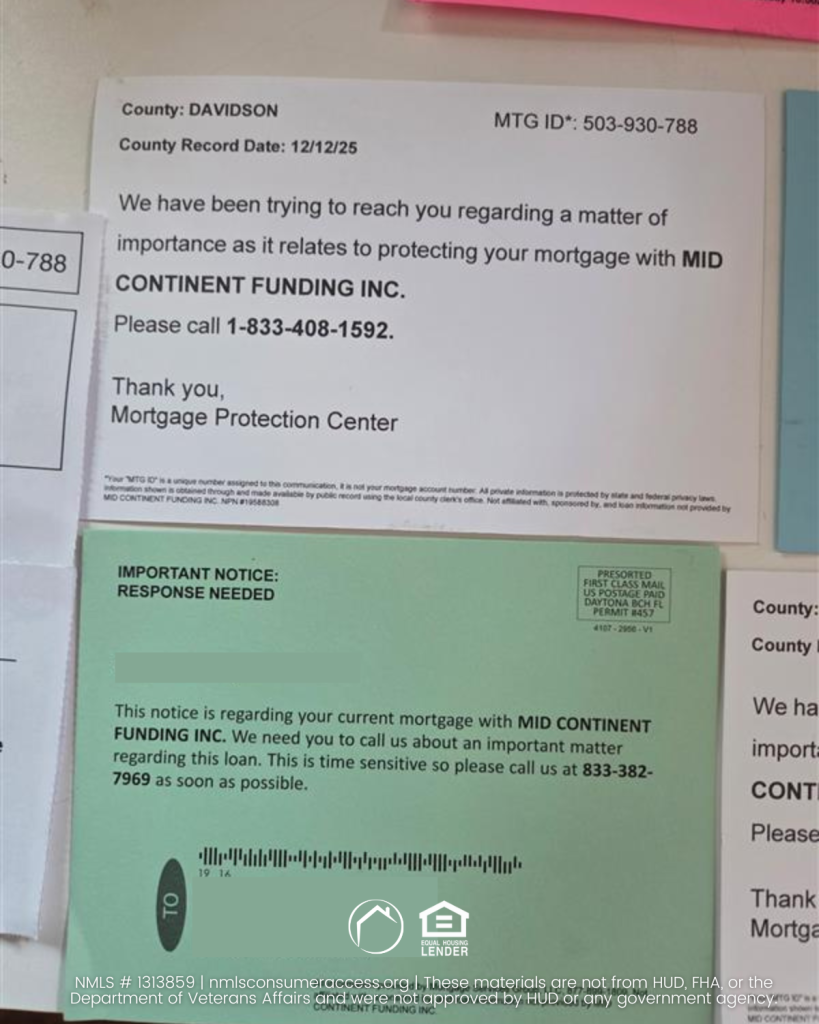

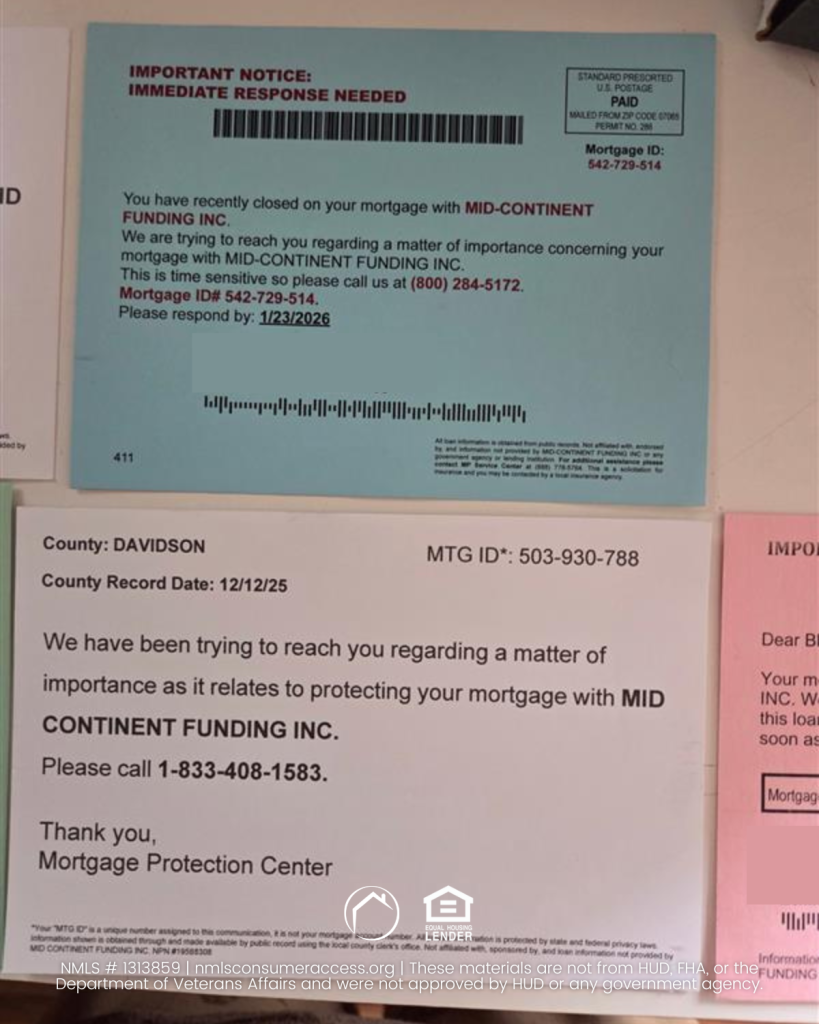

If you’ve recently bought a home or refinanced your mortgage, your mailbox may suddenly be flooded with colorful, official-looking postcards that demand your immediate attention. They often bear a cryptic, alarming message: “Important Matter Regarding Your Recently Closed Mortgage—Call Immediately!” or something similar, urging you to dial an unfamiliar phone number right away.

As a trusted VA-focused mortgage lender, VeteransLoans.com wants to be unequivocally clear: This is a common scam designed to trick you. Do not call the number. Do not give them any personal information. This misleading mailer does NOT come from your actual lender or any government agency.

We understand how unsettling this can be, especially for military families and Veterans who rely on clear communication and trust. Here is your comprehensive, expert guide to understanding this mortgage postcard scam, protecting your financial future, and maintaining peace of mind in the booming housing market.

What’s Happening: How the Postcard Scam Works

The “Important Matter” postcard scam is a predatory tactic used by third-party companies, often looking to push high-cost, unnecessary financial products like mortgage protection insurance or to engage in aggressive refinancing solicitations. In the worst-case scenarios, it’s an attempt to commit full-blown identity theft.

The Source of the Information

You might be wondering, how do these companies know I just closed on a mortgage? The answer lies in public records.

When you close on a property and secure a mortgage, certain details of the transaction become public information at the local county recorder’s office—often including your name, property address, lender’s name, and the loan amount. Scammers and aggressive marketers regularly scour these public records, especially in areas with dynamic housing market trends, to compile targeted mailing lists.

These postcards are expertly crafted to look urgent and legitimate:

- Sense of Urgency: Phrases like “Time-Sensitive,” “Immediate Response Required,” or “Final Notice” are used to create panic and bypass your critical thinking. They want you to call before you have a chance to think or verify.

- Official Appearance: They use bold text, official-sounding language, and often reference your property address and even the name of your real lender (sometimes abbreviated or slightly misspelled) to create a false sense of authority.

- Vague Threat: The “important matter” is always left vague. Is it an issue with your payment? Your escrow? Your title? This ambiguity is the bait, pushing you to call to resolve the mystery.

Your real lender, like VeteransLoans.com, will never communicate time-sensitive, crucial loan matters through an unsealed, generic postcard with an unverified third-party phone number. Genuine loan communications are sent via official, sealed first-class mail or through direct, verified channels. When in doubt, hang up and call us directly at 888-232-1428.

Essential Tips to Avoid the Mortgage Postcard Scam

Protecting yourself is easier than you think.

Identify the Red Flags of Fraud

- Unsealed Postcard: Legitimate, urgent loan notices are always sent in sealed envelopes, often with clear company branding. An open postcard is a major red flag.

- Vague Language: A real issue would be clearly stated (e.g., “Your annual escrow analysis statement enclosed”). “Important matter” is a tactic, not an explanation.

- Unfamiliar Phone Number: Does the number on the postcard match the customer service number on your monthly mortgage statement or the official number on your lender’s website? If not, do not call it.

- Fine Print Disclaimer: Look for tiny print at the bottom stating something like: “Not affiliated with, sponsored by, or loan information not provided by [Your Lender’s Name].” This is their legal loophole—and your confirmation it’s a non-lender solicitation or scam.

- Request for Sensitive Data: If you do call and they ask for your Social Security number, bank account details, or full mortgage account number right off the bat, hang up immediately.

Verify Directly with Your Lender

If a piece of mail gives you pause, the correct course of action is simple and secure:

- Use a Trusted Number: Do NOT call the number on the suspicious postcard. Instead, find the official phone number on your most recent mortgage statement, official closing documents, or by visiting your lender’s verified website.

- Call Your Lender Directly: Call that trusted number and ask a representative to check your account. Simply state: “I received a postcard about an ‘important matter.’ Can you confirm if my account has any outstanding or urgent issues that would prompt a mailing from your office?”

For VeteransLoans.com customers: If you ever have a doubt, please call our verified line directly at 1 (888) 232-1428. We are here to protect you.

Protect Your Information

- Shred and Dispose: The best way to handle these postcards is to shred them and throw them away. Do not simply toss them in the trash, as they contain your name and address.

- Never Wire Money: Your lender will never ask you to resolve an “important matter” by wiring money, purchasing gift cards, or sending funds via untraceable methods. This is an absolute sign of fraud.

Stop the Spam: How to Opt Out of Unsolicited Offers

While you can’t stop public records from being public, you can significantly reduce the number of unsolicited, pre-screened offers you receive, which are often the basis for this type of scam.

The federal Fair Credit Reporting Act (FCRA) gives you the right to opt out of pre-screened offers for credit and insurance.

Opt-Out of Credit Bureau Lists

This is the most effective step to curb the mailings:

- Visit OptOutPrescreen.com: This is the official consumer website for the major credit bureaus (Equifax, Experian, Innovis, and TransUnion).

- Call 1-888-5-OPT-OUT (1-888-567-8688): This toll-free number is also provided by the major credit bureaus.

You can choose to opt out for five years or opt out permanently. While you will be asked for personal information (like your Social Security Number and Date of Birth) to verify your identity, this information is held securely and used only to process your request.

Opt-Out of Marketing Lists

You can also reduce general commercial mailings, which may catch some of these offers, by registering with the Direct Marketing Association’s (DMA) Mail Preference Service:

- DMAchoice.org: This service allows you to choose what categories of mail you want to stop receiving. A small fee may apply, and the process is managed by a private industry group.

Navigating Your Financial Journey

Closing on a mortgage, especially a VA Loan, is a major accomplishment. Don’t let a deceptive postcard disrupt the excitement of your new home or deter you from exploring legitimate opportunities like refinancing opportunities in the future.

Staying Vigilant in the Market

The current financial landscape and mortgage interest rate forecasts can make it tempting to listen to unsolicited offers, but vigilance is key. Only pursue rate and term checks through a lender you know and trust, or one you have vetted thoroughly.

VeteransLoans.com is committed to serving Veterans and military families with transparent, secure, and beneficial lending services. Our priority is your financial security, not misleading marketing.

If you are ever considering a future move, a cash-out refinance to fund education or home improvements, or a streamlined VA Interest Rate Reduction Refinance Loan (IRRRL), we invite you to start with a trusted source.

Need Verified Information? Contact Us.

If a postcard or call has you concerned, or if you simply want to explore your current and future VA loan benefits with a trusted, official source, do not hesitate to reach out.

- Start Your Pre-Qualification: To speak with a certified loan specialist and begin exploring your legitimate options for purchase or VA refinancing opportunities, you can start your secure pre-qualification process right now: Get Pre-Qualified

- Call Our Official Line: For immediate assistance and to verify any suspicious communication, call us directly at: 1 (888) 232-1428

Stay safe, stay vigilant, and thank you for your service.